kansas sales tax exemption certificate

1760 Exemptions Instructional Bulletin 36 see p. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

Virginia Sales Tax Exemption Certificate Unlike a Value Added Tax VAT the Virginia sales tax only applies to end consumers of the product.

. Individuals and companies who are purchasing goods for resale improvement or as raw materials can use a Utah Sales Tax Exemption Form to buy these goods tax-free. 64H 6 Sales Exempt from Tax AP 102. Certificate from all of its customers Buyers who claim a salesuse tax exemption.

The certificate contains a list of exemptions on its face including tangible personal property that is sold to the Federal Government. Companies or individuals who wish to make a qualifying purchase. For a Kansas sales tax exemption certificate to be provided to vendors for University purchases or for information regarding the Universitys sales tax exemption status in other states please contact KSU General Accounting office at 785 532-6202.

If the Seller does not have this certificate it is obliged to collect the tax for the state in which the property or service is delivered. How to use sales tax exemption certificates in Mississippi. Individuals and companies who are purchasing goods for resale improvement or as raw materials can use a Virginia Sales Tax Exemption Form to buy these goods tax-free.

Companies or individuals who wish to make a qualifying purchase tax. For Project Exemption Certificates a project specific sales tax exemption number to be provided by the. In section 2 the buyer will provide a description of the items they will be purchasing.

Kansas Notice 04-09. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. 2 Maine 36 MRS.

For other South Carolina sales tax exemption certificates go here. This certificate provides an exemption to purchasers when they are working together with a governmental agency. Generally a Buyer must be registered as a retailer for salesuse tax in states where the Buyer has salesuse tax nexus.

DiplomaticConsular Exemptions Directive. The salesuse tax registration. Kentucky KRS 139470 Exempt Transactions Louisiana Department of Revenue.

Utah Sales Tax Exemption Certificate Unlike a Value Added Tax VAT the Utah sales tax only applies to end consumers of the product. Massachusetts ALM GL ch. Step 3 If the retailer is expected to be purchasing items frequently from the seller instead of completing a sales tax exemption certificate for every invoice check the blanket purchase exemption request box.

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

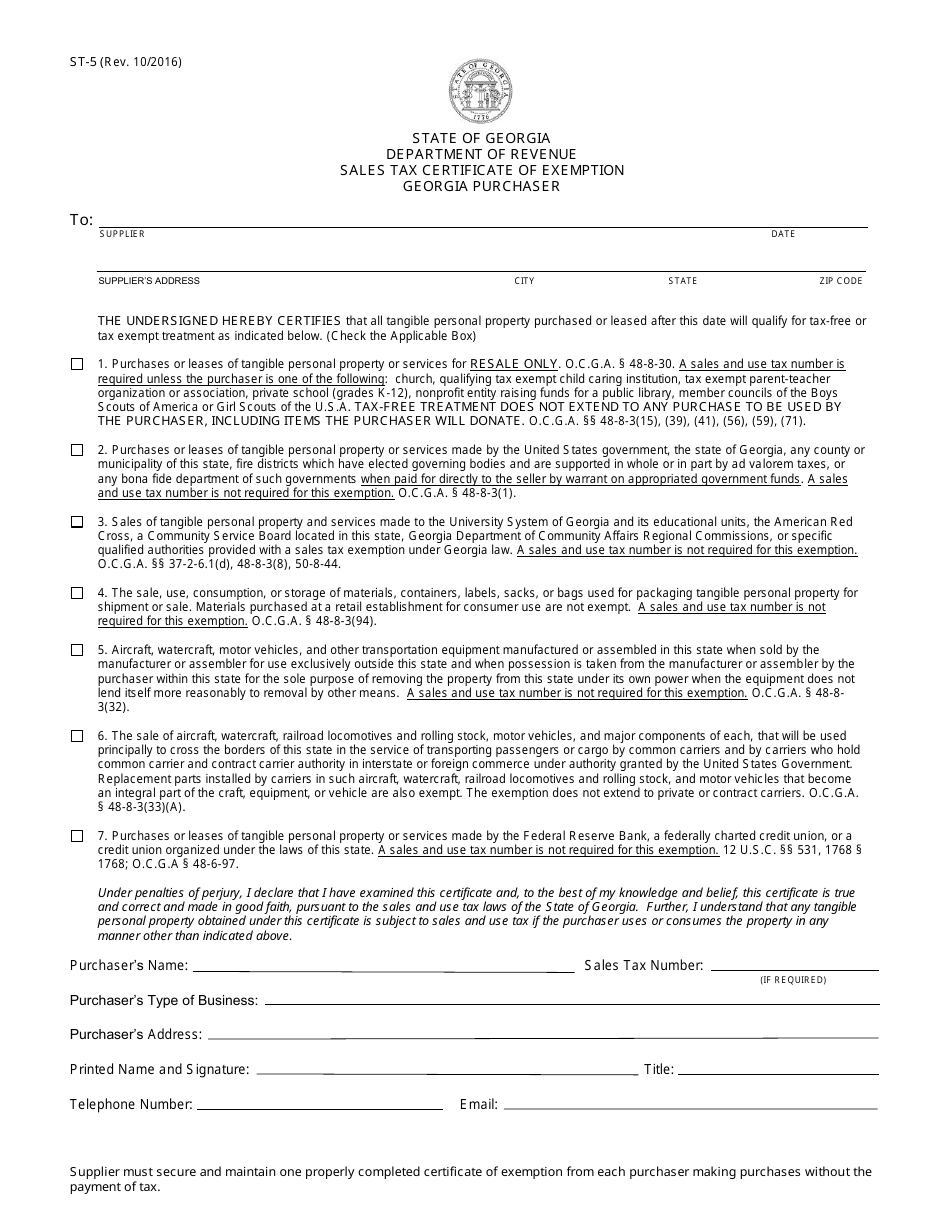

Form St 5 Download Fillable Pdf Or Fill Online Sales Tax Certificate Of Exemption Georgia Purchaser Georgia United States Templateroller

Kansas Resale Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

Fillable Online Baldwincity Kansas Department Of Revenue Baldwincityorg Fax Email Print Pdffiller

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

Kansas Exemption Form Fill Out And Sign Printable Pdf Template Signnow

Kansas Tax Exempt Form Pdf Fill Online Printable Fillable Blank Pdffiller

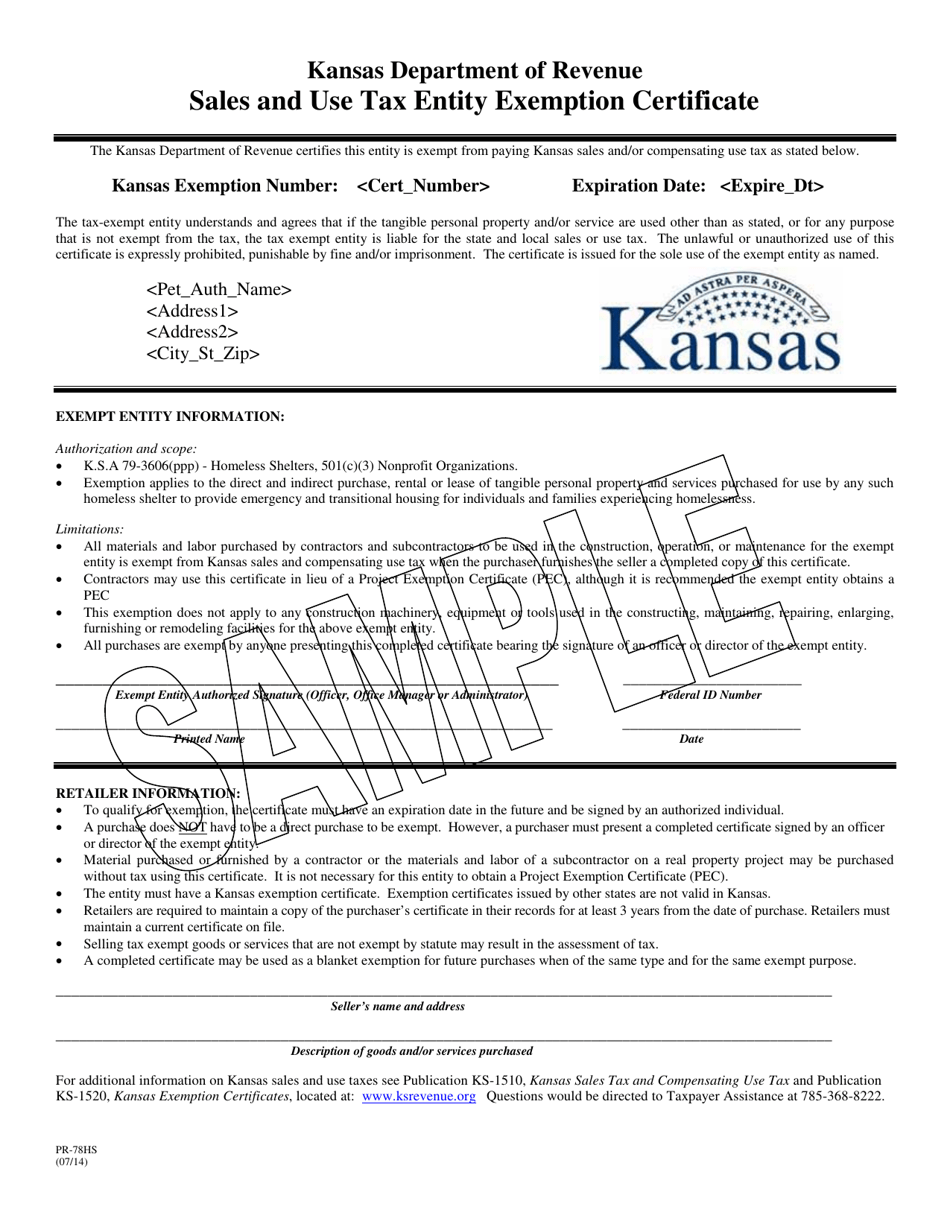

Form Pr 78hs Download Printable Pdf Or Fill Online Sales And Use Tax Entity Exemption Certificate Homeless Shelters Sample Kansas Templateroller

2005 Form Ks Pr 74 Fill Online Printable Fillable Blank Pdffiller

How To Get A Resale Exemption Certificate In Kansas Startingyourbusiness Com

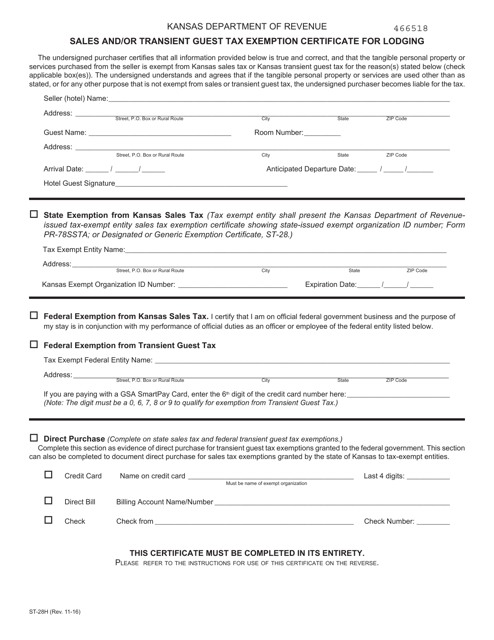

Form St 28h Download Fillable Pdf Or Fill Online Sales And Or Transient Guest Tax Exemption Certificate For Lodging Kansas Templateroller