will capital gains tax rate change in 2021

4 rows The proposal would increase the maximum stated capital gain rate from 20 to 25. There is a change on the horizon which can take place as soon as 2022.

Long-term capital gains are taxed at lower rates than ordinary income while short-term capital.

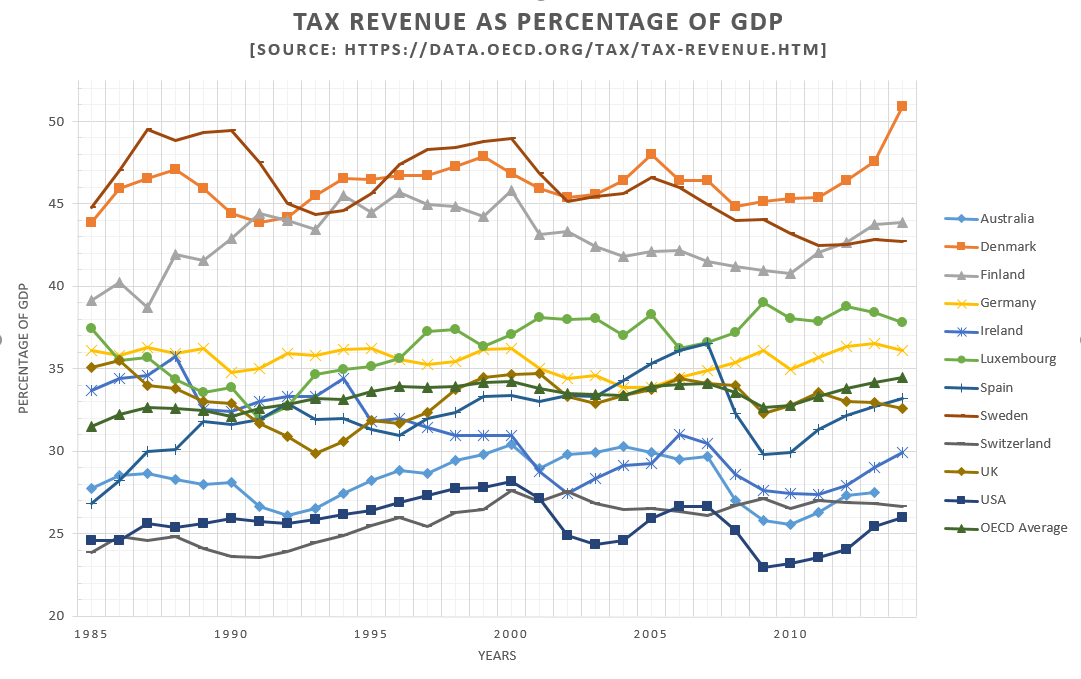

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

. This new rate will be effective for sales that occur on or after Sept. The maximum capital gains are taxed would also increase from 20 to 25. Capital gains and losses are taxed differently from income like wages interest rents or royalties which are taxed at your federal income tax rate up to 37 for 2022.

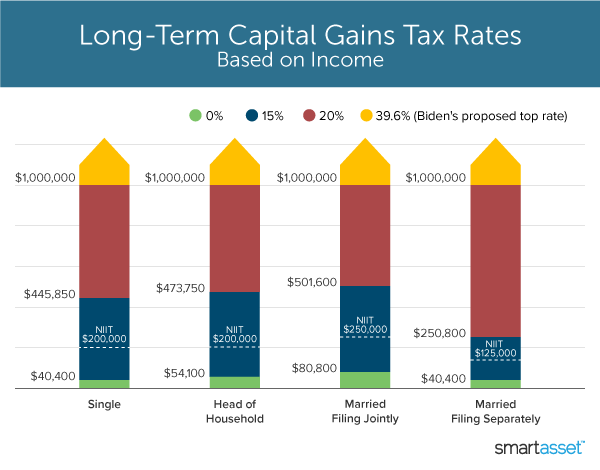

5 rows The rates do not stop there. The tax rate on most net capital gain is no higher than 15 for most individuals. Another would raise the capital gains tax rate to 396 for taxpayers earning 1 million or more.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year. As a result Janet would owe zero tax on about 10400 of her gain and 15 on about 9600 of it. Capital gains tax rates on most assets held for less than a.

This years tax deadline for most individuals is April 18. 2021 the date House. Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed.

Long-term capital gains are taxed at either 0 15 or 20 depending on your tax bracket. The proposal is bumping this up to 396. Will capital gains change in 2021.

7 rows 2021 federal capital gains tax rates. Capital gains tax rates for tax years 2022 For example in 2021 individual filers who earn under 40000 without deducting business expenses will not have to pay capital gains tax. If they earn between 40401 and 445850 they are subject to.

The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35. According to Nate Tsang the Founder and CEO of Wall Street Zen tax on a long-term capital gain in 2021 is 0 15 or 20 based on the investors taxable income and filing status excluding any state or local taxes on capital gains. 13 2021 and will also apply to Qualified Dividends.

In his budget plan released May 28 Biden proposed making the capital gains tax changes retroactive to April 2021 in order to prevent wealthy taxpayers from quickly selling off assets to avoid the. For 2021 the 15 bracket for capital gains begins at 40401 of taxable income for single filers. The tables below show marginal tax rates.

Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to 40400 for single or 80800 for married filing jointly or qualifying widow er. Joe Biden says this tax increase funds a 18 trillion dollar. Those changes are expected to cost up to 35 trillion.

There are exceptions to this such as when it was 15 from 2004 to 2012. If you sell small-business stocks or collectibles the maximum. Congress hasnt made changes to rates on long-term capital gains and dividends for 2021 and 2022.

For assets held less than one year short-term gains are taxed at regular income rates which may be as high as 34 based on the taxpayers individual income. Discover Helpful Information and Resources on Taxes From AARP. Still another would make the change.

Currently the capital gains tax rate for wealthy investors sits at 20. Historically capital gains tax has sat around 20. However you may only pay.

In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288. Your 2021 Tax Bracket to See Whats Been Adjusted.

Long-term capital gains taxes are assessed if you sell investments at a profit after owning them for more than a year. Ad Compare Your 2022 Tax Bracket vs.

House Capital Gains Tax Better For The Super Rich Than Biden Plan

Capital Gains Definition 2021 Tax Rates And Examples

2022 And 2021 Capital Gains Tax Rates Smartasset

Capital Gains Definition 2021 Tax Rates And Examples

2022 And 2021 Capital Gains Tax Rates Smartasset

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Dividend Tax Rates In 2021 And 2022 The Motley Fool

2022 And 2021 Capital Gains Tax Rates Smartasset

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Capital Gains Definition 2021 Tax Rates And Examples

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

How Do Taxes Affect Income Inequality Tax Policy Center

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)